Comprehensive Edition

When existing major Korean industries have matured, they may experience slower economic growth and lose job creation potential. New growth engine industries are those that will continually bring high value-added industries through the evolution of existing industries in technological innovations, convergence, and services. In 2009, the government selected 17 new growth engine industries in three major growth fields, namely green technology, high technology convergence industry, and high value-added services. Convergence industry is one that integrates digital components to industries that did not utilize them before. New growth engine industries that belong to manufacturing categories include the broadcasting and communications convergence industry, IT convergence system industry, robotic application industry, advanced materials and nanotechnology convergence industry, bio-pharmaceutical industry, medical appliances and instruments industry, and high value-added food industry.

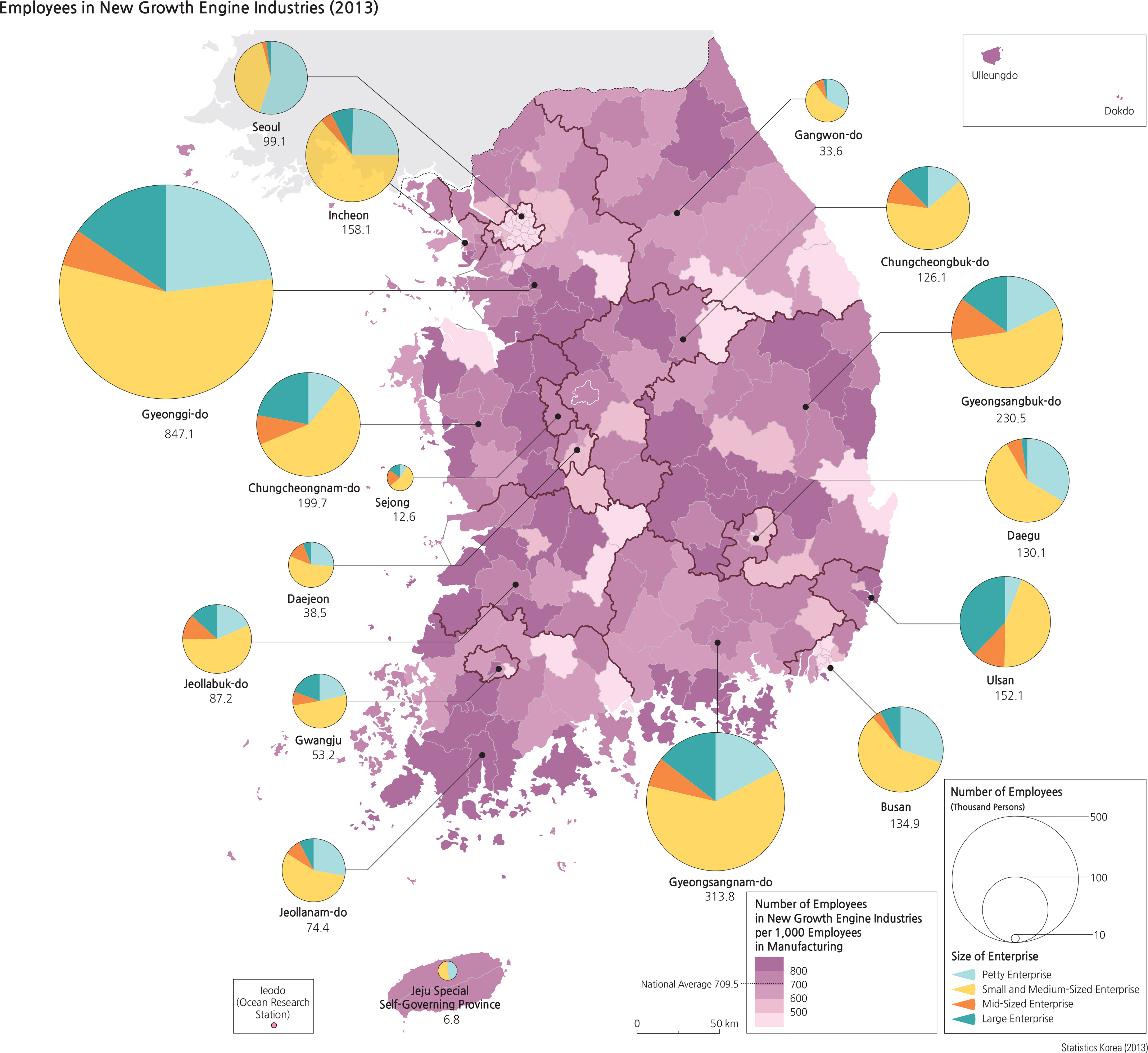

As of 2013, there were 233,099 enterprises in new growth engine industries in Korea with 2.69 million employees, constituting 62.9% of the total manufacturing enterprises and 71.0% of the total employees, respectively. In terms of enterprise size, there were 88 large enterprises, 428 mid-size enterprises, 44,438 small to medium enterprises (SMEs), and 188,145 petty enterprises, making up 0.03%, 0.2%, 19.1%, 80.7% of the total enterprises, respectively; these percentage distributions reveal a heavy concentration in small industries. Regional distribution of enterprises centered in Gyeonggi-do (29.8%), Seoul (10.1%), Gyeongsangnam-do (9.4%), Daegu (7.6%), Busan (7.2%), Gyeongsangbuk-do (7.1%), and Incheon (6.3%). Of the total new growth engine industries, 46.2% were located in the Greater Seoul Metropolitan Area.

Brief Interpretation of the Map

|