English III

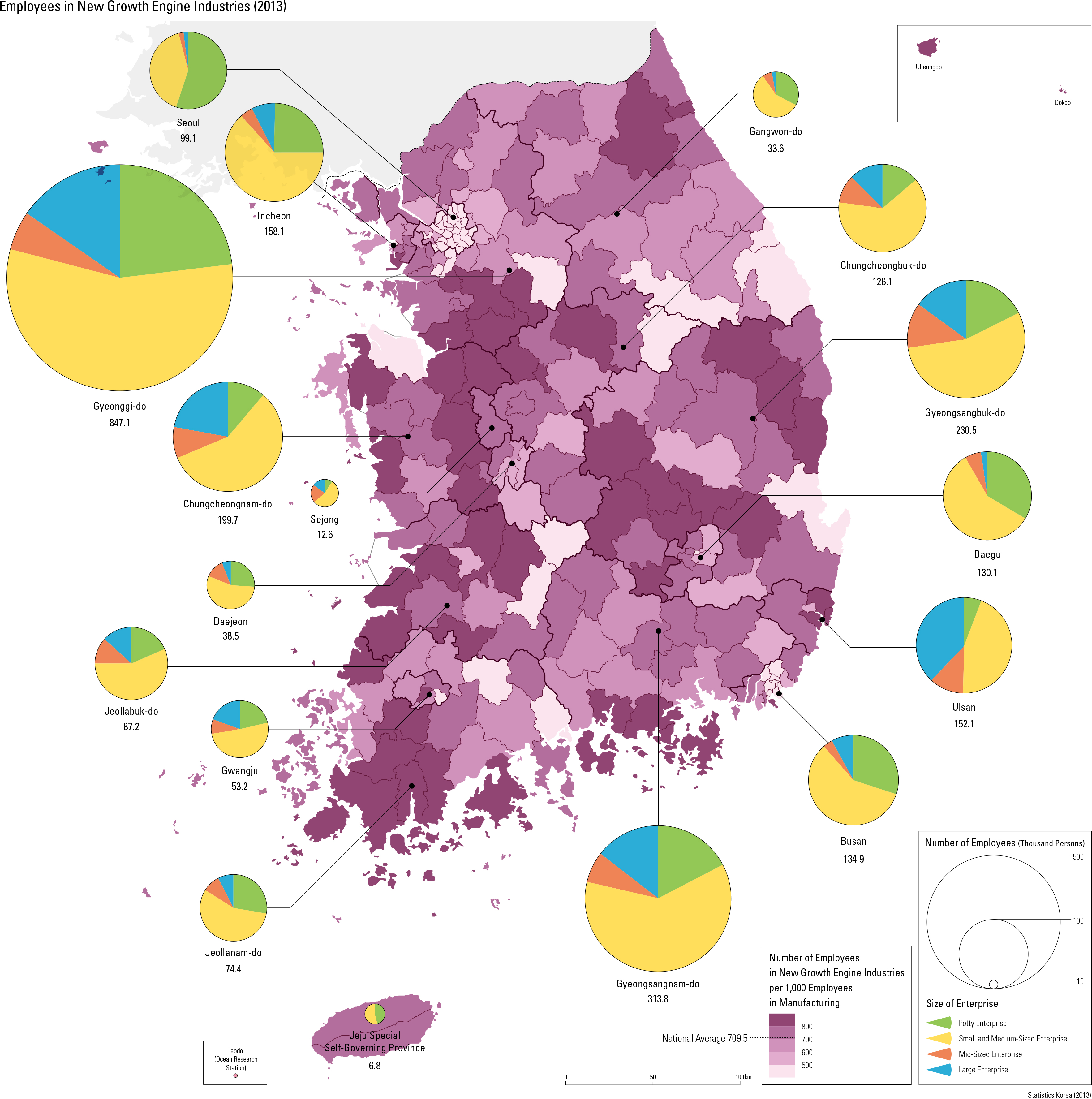

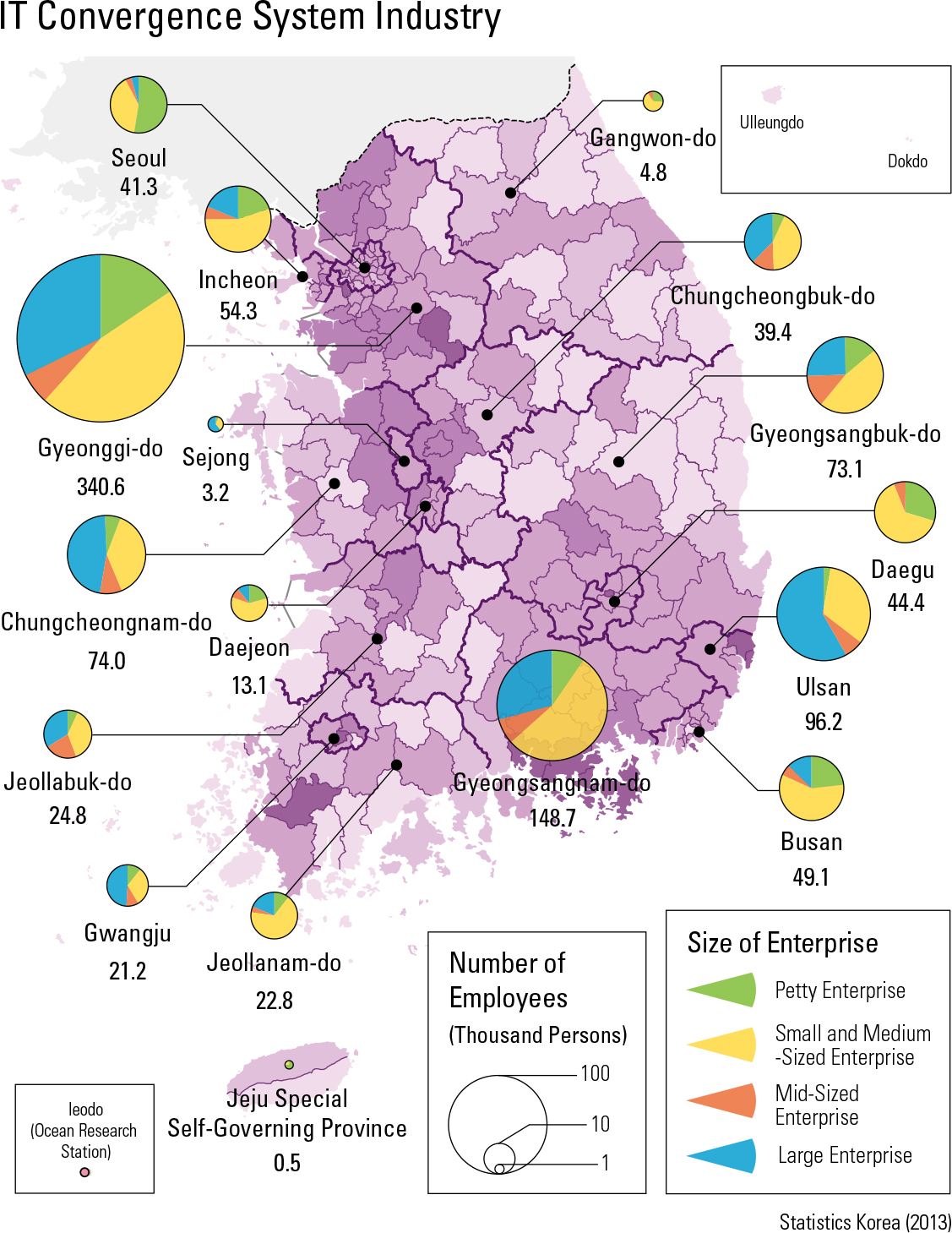

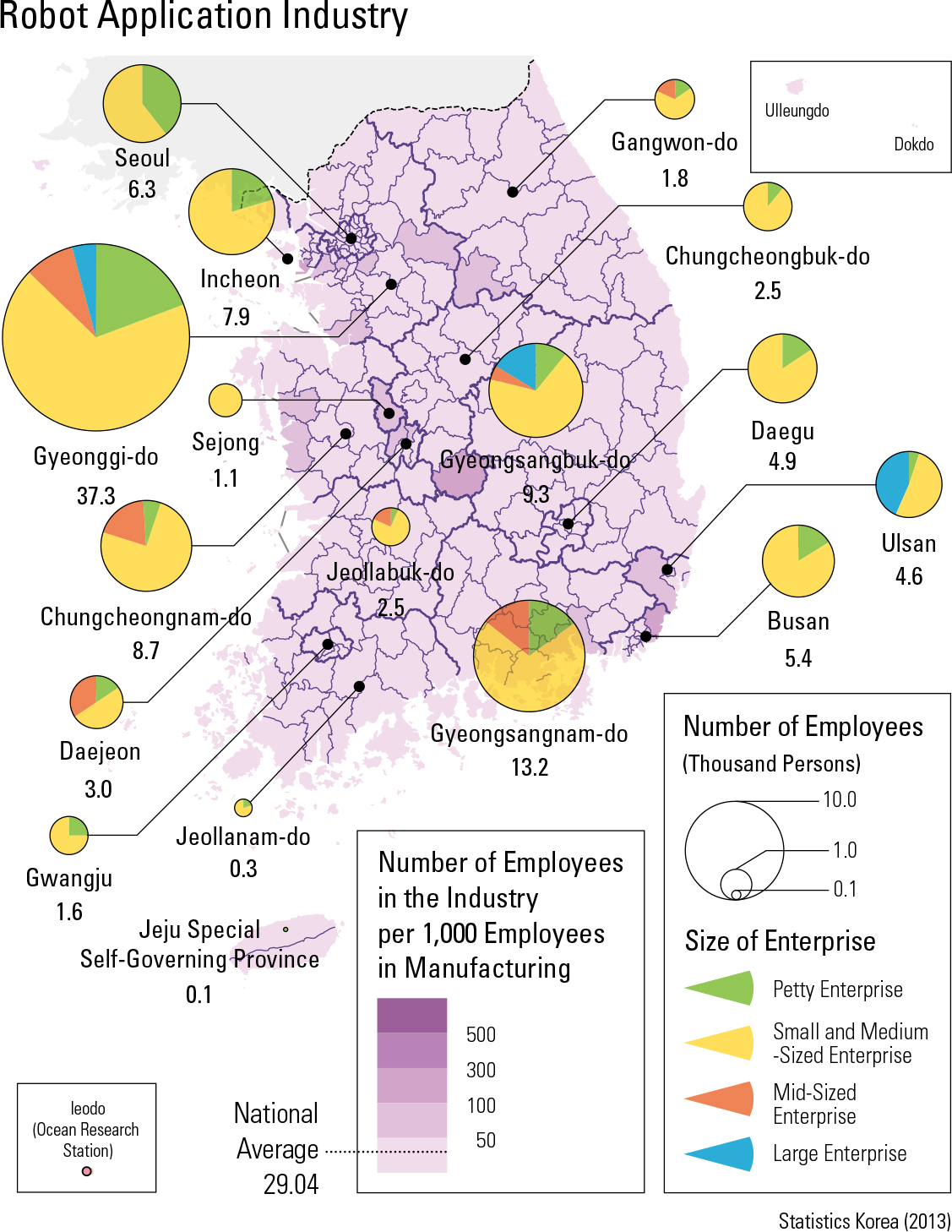

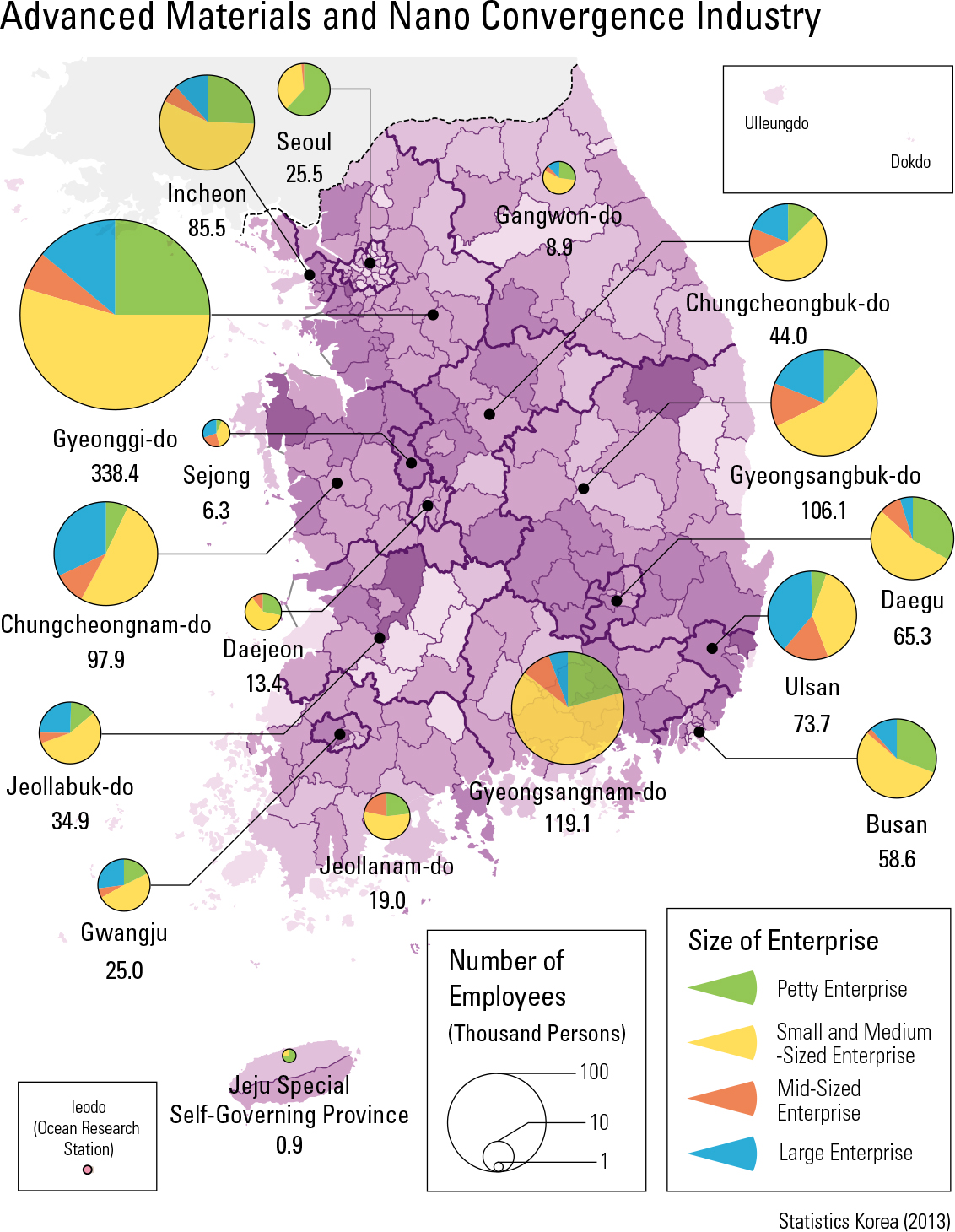

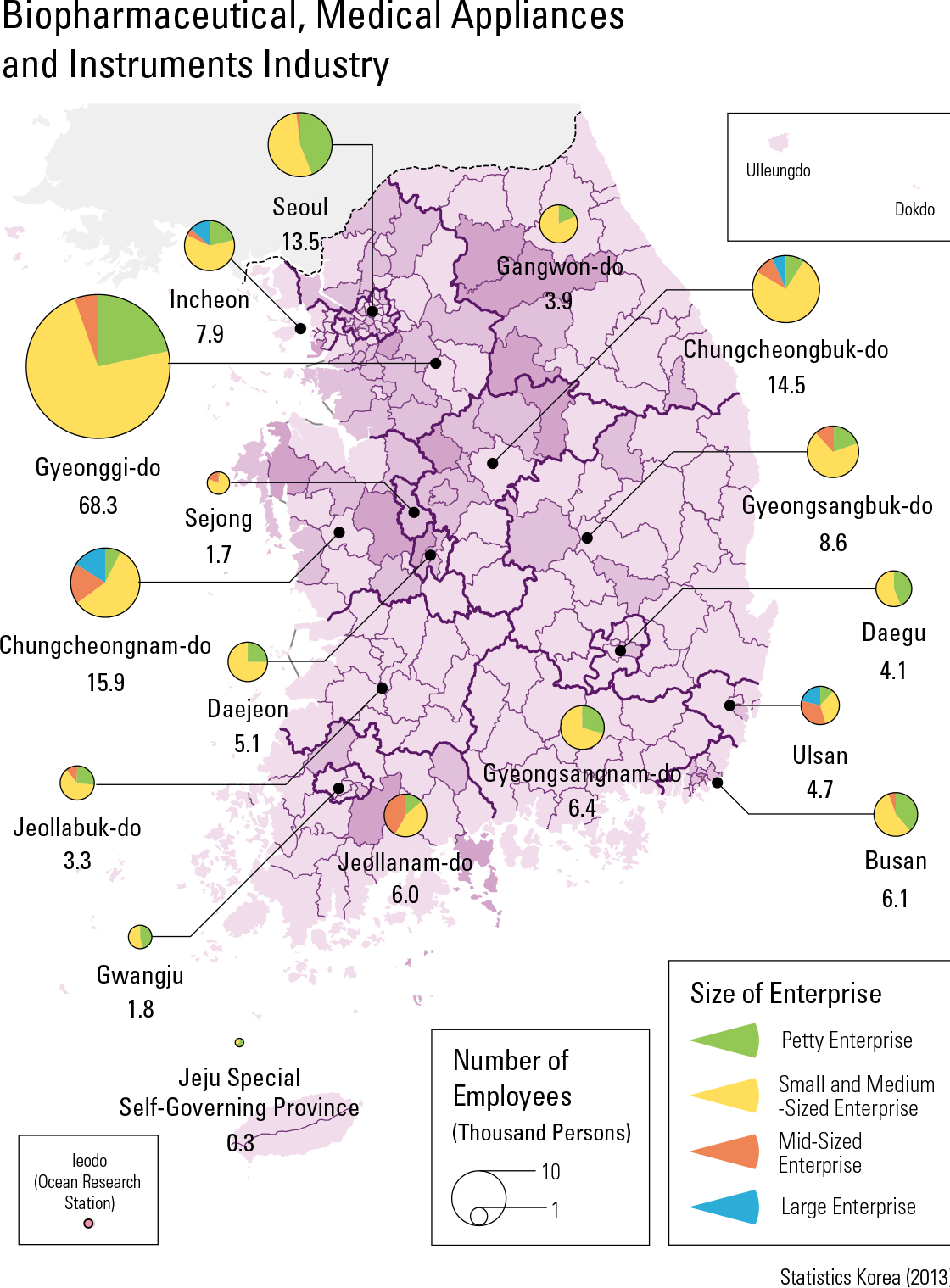

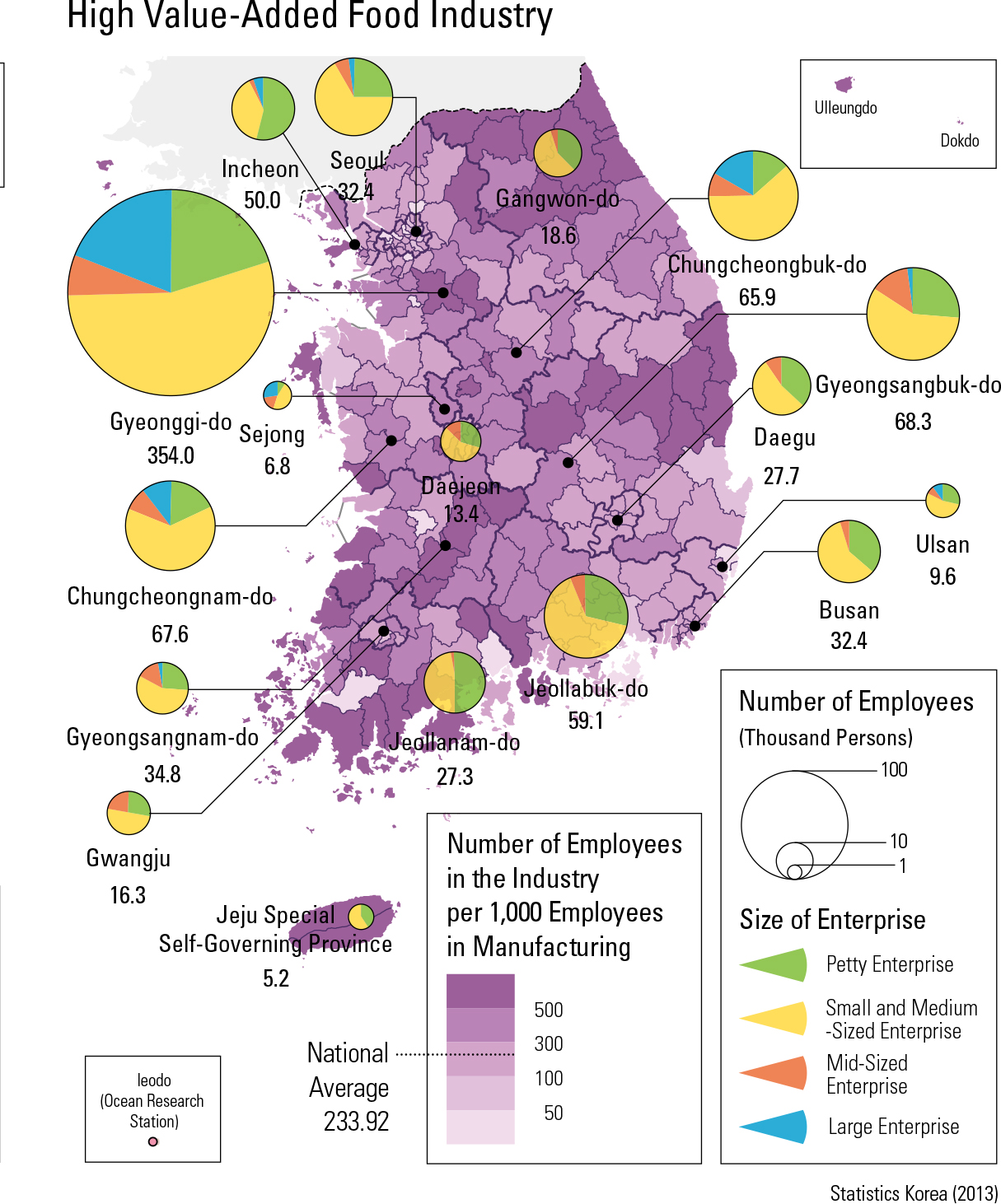

New growth engine industries are those that will continually bring high value-added industries through the evolution of existing industries in tech- nological innovations, convergence, and services at a time when existing major Korean industries have matured to a level that is causing overall slow economic growth and deterioration of job creation potential. In 2009, according to the “Comprehen- sive Plan for New Growth Engine Industries,” the government selected 17 new growth engine indus- tries in three major growth fields, namely green technology, high technology convergence industry, and high value-added services. New growth engine industries that belong to manufacturing categories include the broadcasting and communications con- vergence industry, IT convergence system industry, robotic application industry, advanced materials and nano convergence industry, bio-pharmaceuti- cal industry, medical appliances and instruments industry, and high value-added food industry. As of 2013, there were 233,099 enterprises in new growth engine industries in Korea with 2.69 million employees, constituting 62.9% of the total manufacturing enterprises and 71.0% of the total employees, respectively. In terms of enterprise size, there were 88 large enterprises, 428 mid-size enterprises, 44,438 SMEs, and 188,145 petty en- terprises, making up 0.0%, 0.2%, 19.1%, 80.7% of the total enterprises, respectively; these percentage distributions reveal a heavy concentration in small industries. Regional distribution of enterprises centered on Gyeonggi-do (29.8%), Seoul (10.1%), Gyeongsangnam-do (9.4%), Daegu (7.6%), Busan (7.2%), Gyeongsangbuk-do (7.1%), and Incheon (6.3%). Of the total new growth engine industries, 46.2% were located in the Greater Seoul Metropol- itan Area. As of 2013, there were 4,621 enterprises employ- ing 125,757 workers in the broadcasting and com munications convergence industry, which made up 2.0% of total enterprises and 4.7% of total employ- ees within the new growth engine industries. There were 7 large enterprises (0.2%), 20 mid-size en- terprises (0.4%), 1,623, SMEs (35.1%), and 2,971 petty enterprises (64.3%). The regional distribution of enterprises indicated the highest concentration in Gyeonggi-do (46.9%), followed by Seoul (14.7%), Incheon (11.6%), and Gyeongsangbuk-do (10.0%). %). In particular, Suwon-si ranked highest (39.1%) in terms of the proportion of employment followed by Gumi-si (22.1%), Gangseo-gu in Seoul (14.0%), and Seongnam-si (13.4%).

page_2 |