English I 2019

Fiscal self-reliance ratio and financial independence ratio are indicators of local autonomous bodies’ revenue decentralization. The fiscal self-reliance ratio is the ratio of local revenue (local tax, non-tax income) to the budget of the local autonomous body. The financial independence ratio is the ratio of local revenue and dependent revenue, including local grant tax, fiscal compensation, and fiscal adjustment, to the budget of the local autonomous body. The fiscal self-reliance ratio is the degree of self-sufficiency in financing for the autonomous body, while the financial independence ratio is the degree of autonomy of the autonomous body’s use of financial resources. The financial independence ratio of the autonomous body is calculated in consideration of the transfer revenue from the central government to the macro-level autonomous body or the primary autonomous body and the transfer revenue from the macro-level autonomous body to the primary autonomous body.

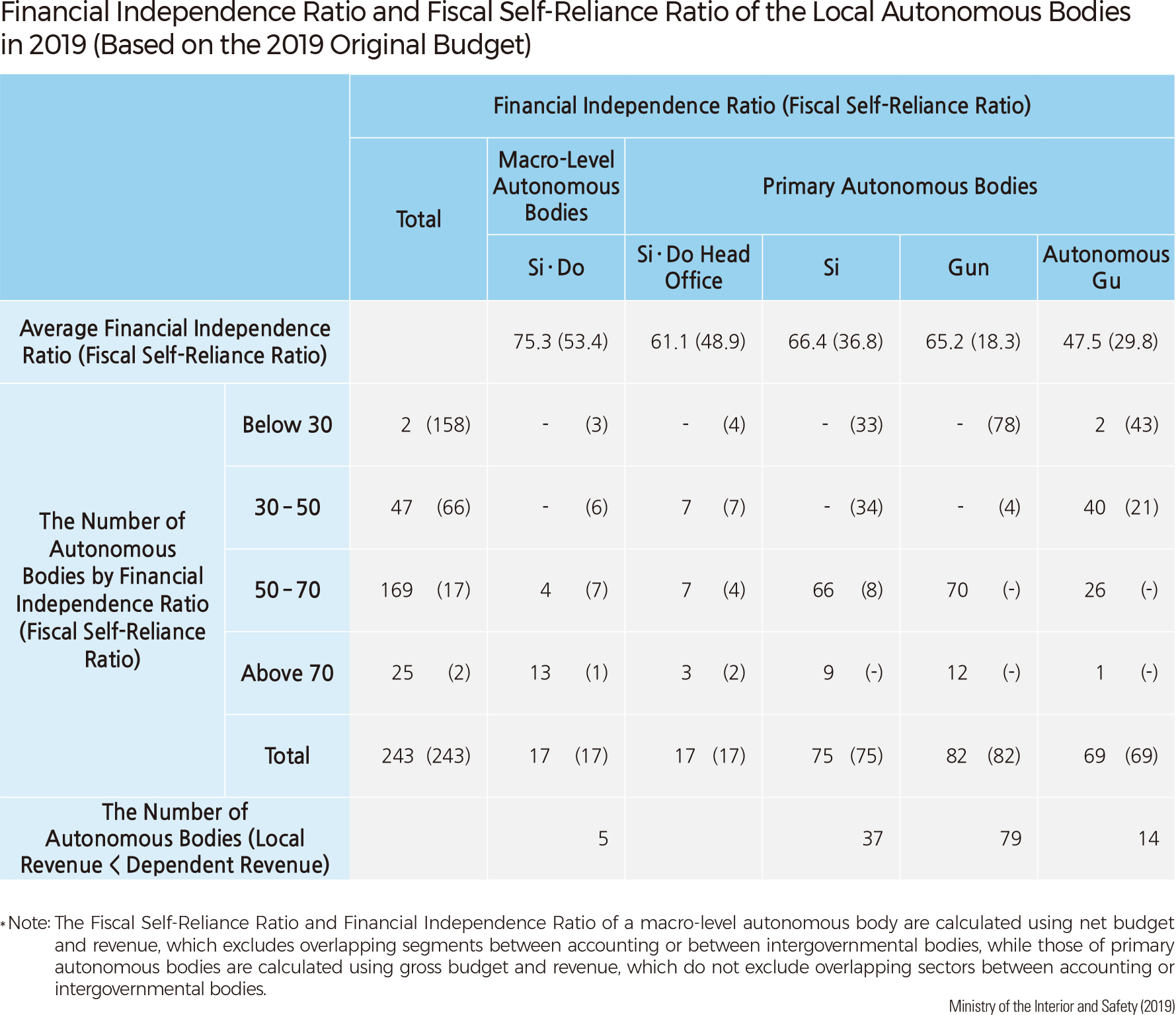

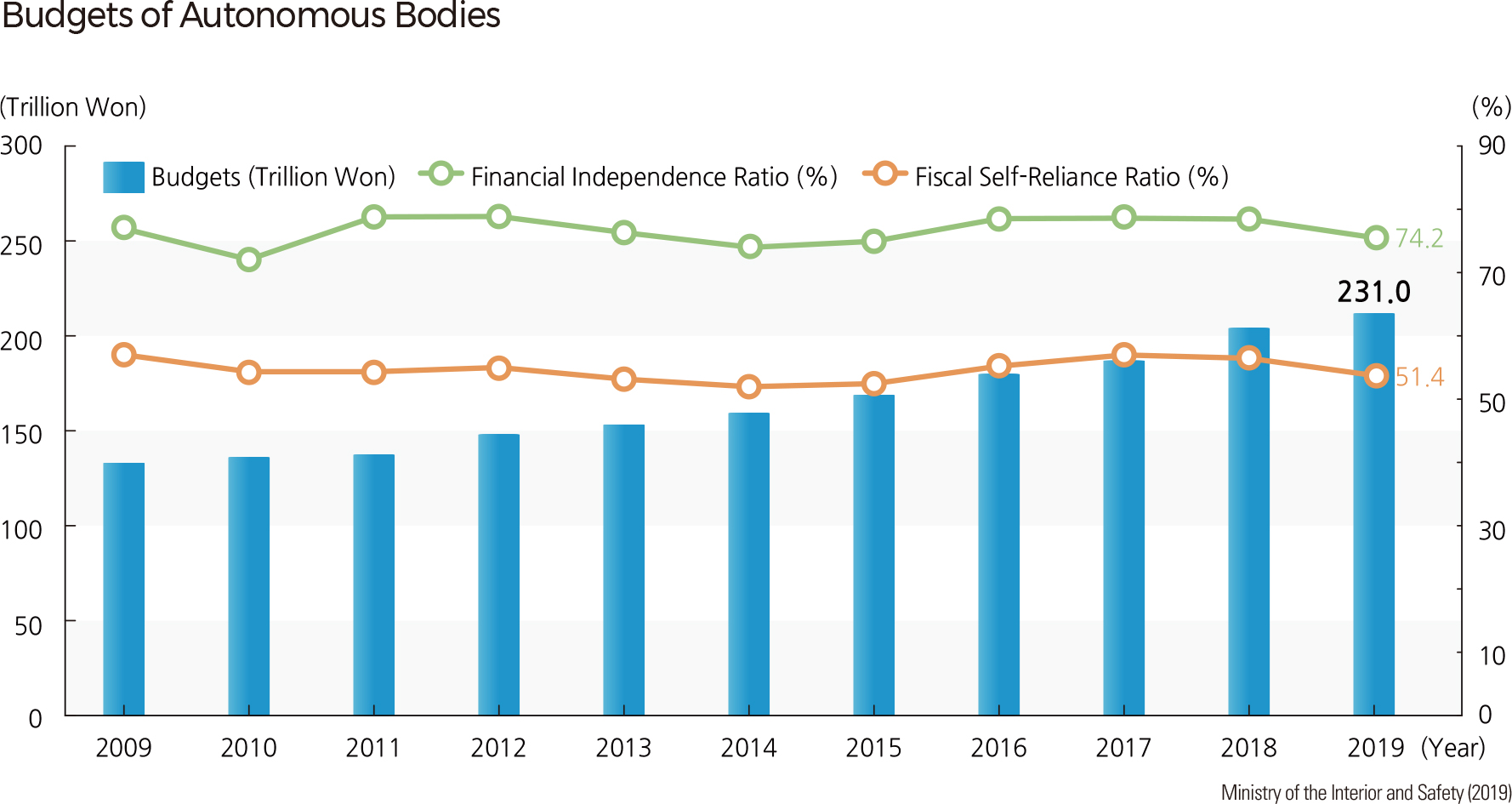

Based on the 2019 original budget, the fiscal self-reliance ratio of ten macro-level autonomous bodies among 17 macro-level autonomous bodies and 213 primary autonomous bodies, which is 94% of 226 primary autonomous bodies, is less than 50%, and the overall fiscal self-reliance ratio of autonomous bodies is poor. On the other hands, the average financial independence ratios of the macro-level autonomous bodies and the primary autonomous bodies are 74.2% and 60.2%, respectively.

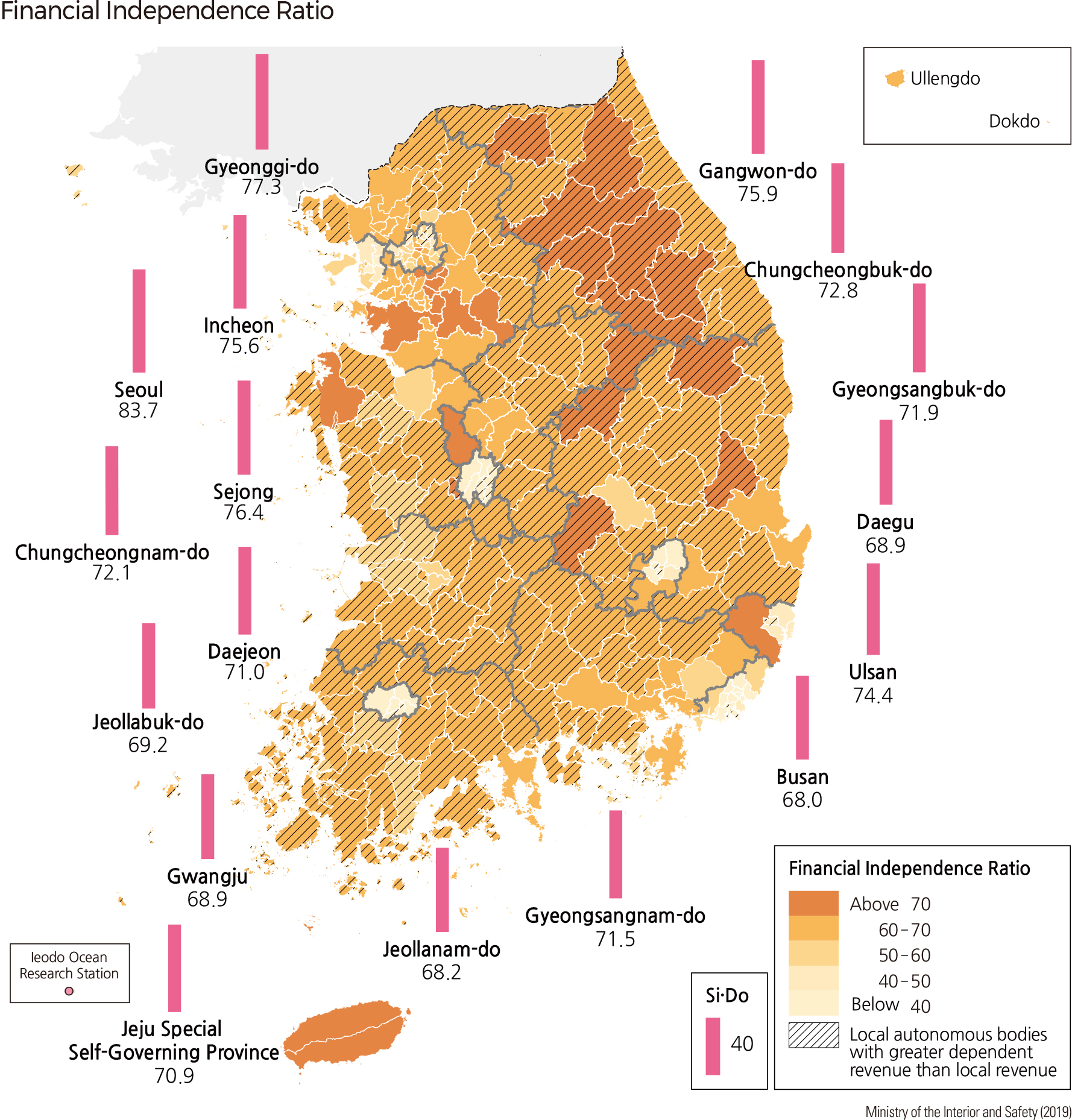

The financial independence ratio is higher than the fiscal independence ratio because the financial independence ratio includes the transfer revenues from central government or macro-level autonomous bodies. Compared to the fiscal self-reliance ratio, the financial independence ratio of macro-level autonomous bodies is 23% higher on average, and the financial independence ratios of sis, guns, and gus are 30%, 47%, and 18% higher on average, respectively. Dependent financial resources have a huge impact on the local autonomous bodies’ finances. There were five macro-level autonomous bodies for which dependent revenue was greater than local revenue, including Gangwon-do, Chungcheongbuk-do, Jeollabuk-do, Jeollanam-do, and Gyeongsangbuk-do. In the primary autonomous bodies, 130 local autonomous bodies had more dependent revenue than local revenue.

Local revenues of local autonomous bodies are steadily increasing due to the increase of local tax revenues. However, both fiscal self-reliance ratios and financial independence ratios for local autonomous bodies have declined because their budgets grow faster than their revenues. The central government tends to increase the ratios by adjusting the ratios of national and local taxes.

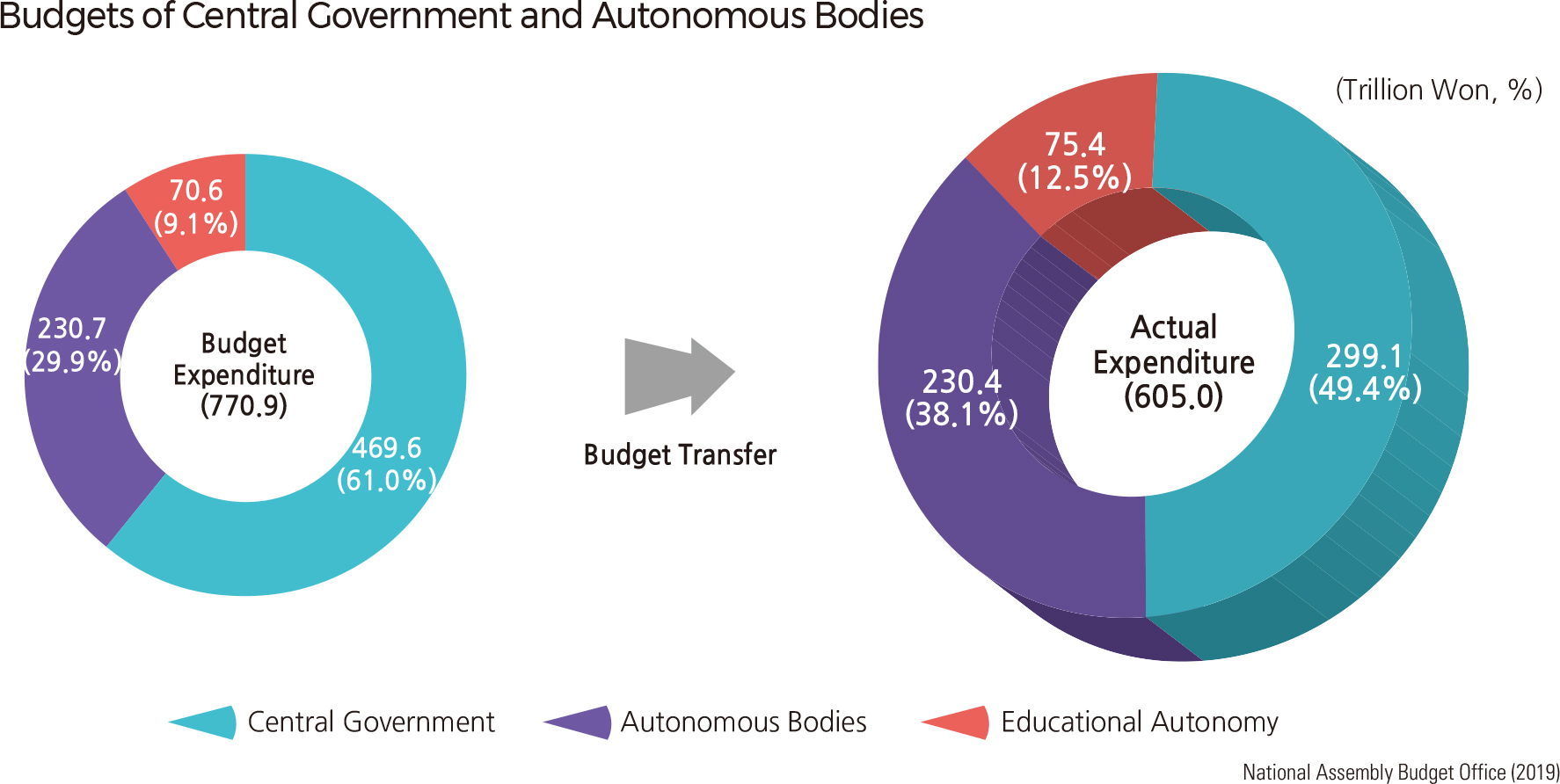

Based on the 2019 budget, the total expenditures of the central government, local autonomous bodies, and local offices of education totaled about 770.9 trillion won. The central government transfers revenue resources to local autonomous bodies and local offices of education, and local autonomous bodies transfer revenue resources to local offices of education. As a result, the actual expenditure of the central government, local autonomous bodies, and local offices of education is approximately 605 trillion won, and the proportion of expenditures used by each governing body is 49.4%, 38.1%, and 12.5%, respectively.

After the full implementation of the local autonomy in 1995, the local autonomous body is part of the national administration and serves as a local government that is separate from the central government. Financial support for the local autonomous body must precede proper implementation of local autonomy. Finance of the local autonomous body consists of income for local autonomous bodies, including local taxes, non-tax income, municipal bonds, preserved income, and transfer revenue from the central government.

As of 2018, the proportion of national and local taxes to total taxes was 78.3% and 21.7%, respectively, with 3.6 times more national taxes than local taxes. The central government will transfer about 170 trillion won in revenue resources to local governments in 2019 because local governments’ revenues are smaller than their expenditures. The government plans to increase the ratio of national and local taxes to 7: 3 by 2022, in accordance with the amplification scheme of local finance.

Just as the local government's finances have to rely on the central government’s financial support due to the low proportion of local taxes to total taxes, the administrative authority of local governments is still smaller than that of central administrations. Since local autonomy was implemented, the central government has gradually transferred central administrative authority to the local autonomous bodies.

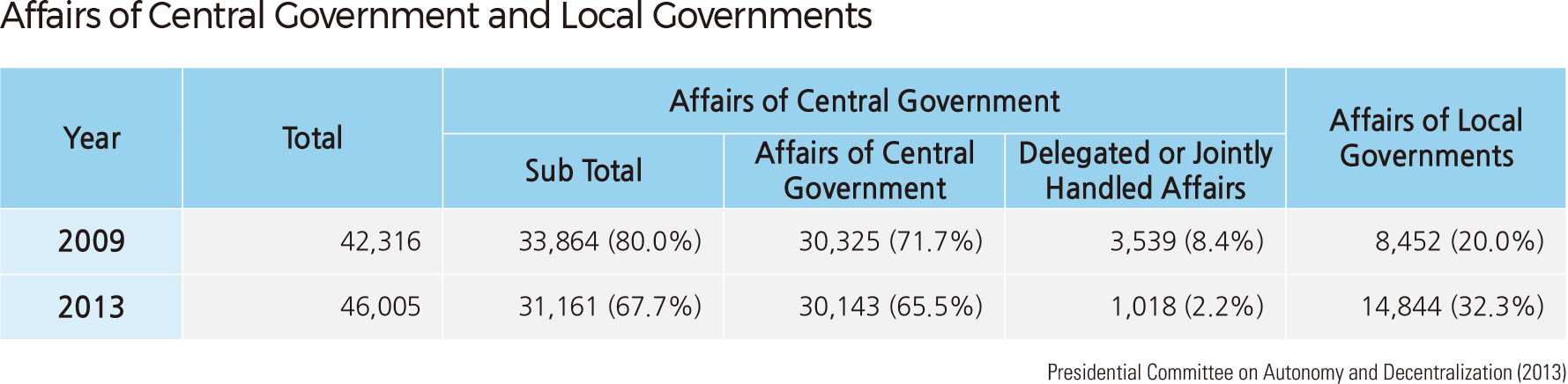

As of 2009, the ratio of national and local affairs was 80:20. Given that the ratio was 67.7:32.3 in 2013, the ratio of local affair increased as a result of the transfer of the national affairs that were delegated or jointly handled with local autonomous bodies and a large number of the affairs under the central government’s own administrative authority. In recent years, the central government has planned to collectively transfer 571 administrative affairs specified in 66 Acts to local autonomous bodies, going further than just transferring simple executive affairs to the local autonomous bodies. |